How Higher Health Insurance Premium Discourage Smoking And Obesity

Embracing a healthier lifestyle enshrouded in intentional habits has never been more critical. With the stark realities of contemporary living, steadily rising health insurance premiums have started to play a consequential role in nudging us towards making healthier choices. In an unexpected twist, these premiums may not only be considered a financial burden, but a saving grace for our lives. Such is the tale of how increased health premiums have begun discouraging practices like smoking and obesity; once commonly perceived lifestyle choices, these are now hailed as life-threatening habits we cannot afford to indulge in—both physically and financially.

The Relationship between Health Insurance Premiums and Lifestyle Choices

Navigating the vast world of health insurance can feel daunting, especially when you consider the multitude of factors that affect premium rates. Health insurance premiums, primarily, are calculated using complex algorithms that take into account a myriad of variables – these include age, geographical area, individual or family enrollment, and your chosen plan coverage. An equally crucial element that health insurance companies take into consideration in their calculation is our lifestyle choices.

How insurance premiums are calculated

Insurance companies employ a technique called risk assessment to predict an individual’s potential health care costs. These risks are assigned a numerical value, which in turn influences the premium rates for that individual. Simply put, where there’s more risk, there’s a higher premium. Factors such as age are taken into account because older individuals are more likely to have a higher risk of utilizing health care services.

Factors influencing insurance premiums

Apart from the age, geographic location, family size, and tobacco usage, insurance companies also take into account the plan category – whether it’s Individual, Family, or Group – and the design of the health plans. The plans are designed to meet specific needs and vary in cost-sharing, like deductibles, copayments, and out-of-pocket maximums, which can greatly influence the premium. Each factor plays a role in determining the cost you pay for insurance.

The link between lifestyle choices and premiums

While certain factors like age and geographical area are non-negotiable, lifestyle choices like tobacco use, unhealthy eating habits, and physical inactivity significantly influence our risk of developing chronic conditions and serious illnesses. These choices directly impact our insurance premiums, turning them into financial reminders of the toll our habits take on our health.

Understanding the Impact of Smoking on Health Insurance Premiums

Smoking, one of the most common yet avoidable lifestyle choices affecting health, has a profound impact on health insurance premiums. Its associated health risks are numerous and varied, making smokers a high-risk group for insurance companies.

The health risks associated with smoking

Smoking is a leading cause of preventable deaths and diseases, affecting most organs in the body. It increases the risk of developing heart disease, stroke, lung and other cancers, cataracts, rheumatoid arthritis, and many other severe health conditions. As a result, smokers typically require more medical care, preventative treatments, and medications, leading to higher overall health care costs.

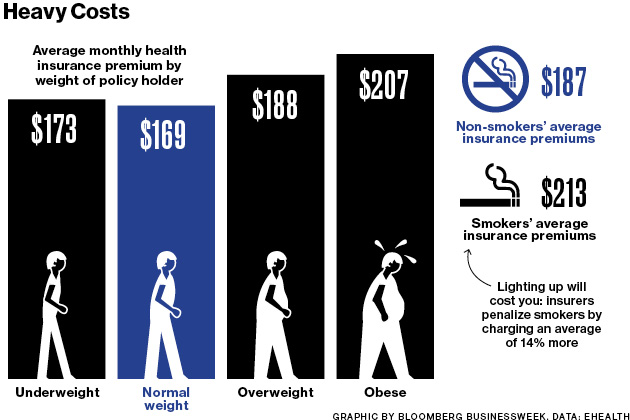

How smoking raises health insurance premiums

Due to increased health risks and associated costs of care, smokers often face higher insurance premiums than non-smokers. This is known as a tobacco surcharge or smoker’s penalty, with the extra amount depending on the individual’s age, plan category, and state regulations. It’s a direct illustration of cause and effect in insurance pricing – the heavier the risk, the heavier the price.

Long term financial implications for smokers

Beyond immediate health consequences, smoking has considerable long-term financial implications. Higher premiums over the course of a lifetime can result in substantial financial loss, especially when compounded with other expenses like cigarette costs, higher medical bills, and potential lost wages from illness.

Implications of Obesity on Health Insurance Premiums

Obesity is another lifestyle factor that significantly affects insurance premiums. It’s not only a health risk itself, but it also amplifies the possibility of developing myriad other serious health conditions.

Obesity-related health risks

Obesity, in medical terms, is not merely about excessive weight. It runs deeper, affecting heart health, blood pressure, bone and joint health, and potentially leading to conditions like type 2 diabetes, heart disease, stroke, gallbladder disease, and certain types of cancer.

How obesity contributes to higher premiums

Similar to smokers, individuals with obesity are likely to face higher insurance premiums, a manifestation of their increased health risks and anticipated healthcare costs. The more severe the obesity, the higher the expected expenditure on health services, and thus the higher the premiums.

Financial incentives to maintain a healthy weight

As a response, many insurance companies offer financial incentives, such as lower premiums, for individuals who maintain a healthy weight. These incentives serve both as a carrot urging us towards healthier habits, and a reinforcement of the financial benefits of maintaining a healthy weight.

The Role of Health Insurance Companies in Encouraging Healthy Behaviors

Insurance companies have a vested interest in promoting healthier lifestyle choices among their policyholders, and they employ various strategies to encourage such behavioral changes.

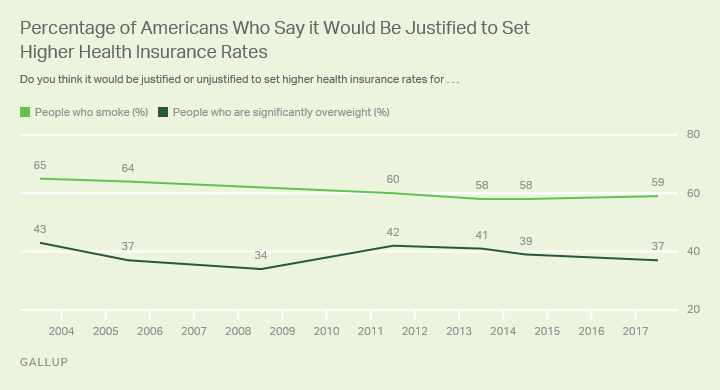

Policies to deter unhealthy habits

Many companies use premium pricing as a tool to deter unhealthy habits. For instance, higher premiums for smokers and individuals with obesity are designed to provide a financial motivation to quit smoking or lose weight.

Incentives for maintaining a healthy lifestyle

Conversely, companies also reward healthy lifestyle choices through premium discounts, fitness program reimbursements, and other wellness incentives. These not only promote better health behaviors but also improve policyholders’ satisfaction and engagement.

Case studies of effective measures

Several insurance companies have successfully implemented wellness initiatives and utilized technology to track policyholder progress. For example, some offer premium discounts to individuals who demonstrate consistent usage of fitness trackers, reflecting a direct commitment to physical activity. Such measures have proven effective, unfolding a win-win situation for both insurers and policyholders.

The Influence of Higher Premiums on Smoking Cessation

Insurance premiums can play a defining role in encouraging people to quit smoking. Financial strain or incentives can be a potent motivator towards healthier habits.

Studies showing insurance premiums impact on quitting

Several studies have corroborated the link between higher insurance premiums and increased smoking cessation rates. For instance, a study involving a large group of smokers revealed that increased premiums significantly influenced their decision to quit smoking, underscoring the potential effectiveness of this financial deterrent.

The role of financial strain in behavior modification

The pinch of higher premiums, particularly robust in lower-income groups, can serve as a powerful incentive to quit smoking. Combined with supportive measures like counseling, it can effectively motivate individuals to break free from the risky habit.

Potential drawbacks and criticisms

While premium-based interventions can be effective, they may also inadvertently lead to under-insurance or non-insurance among smokers unwilling or unable to quit due to addiction. Moreover, critics argue that these measures disproportionately burden people with lower socioeconomic status who are more frequently addicted to smoking.

The Impact of Insurance Premiums on Obesity Rates

Similar to the effect on smoking cessation, research suggests a potential connection between insurance costs and obesity rates.

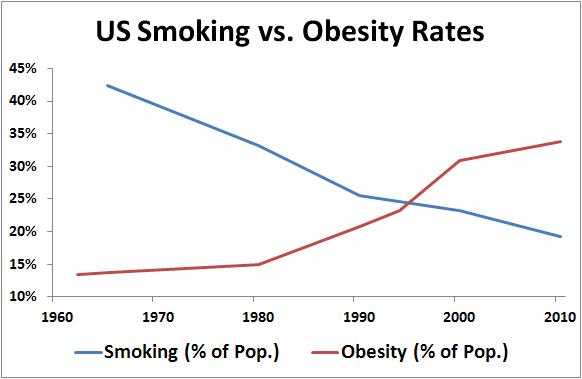

Research linking insurance costs and obesity rate

Studies indicate a subsequent drop in obesity rates in response to increased insurance premiums. The financial implications of higher premiums provide a pragmatic motivation to undertake lifestyle changes leading to weight loss.

Analyzing the effect of financial incentives on weight loss

Financial incentives attached to health insurance, such as lower premiums for those who successfully lose weight or maintain a healthy weight, have shown promising results. Insured individuals tend to participate in weight loss programs more readily when financial rewards or penalties are involved.

Limitations of this approach

While financial incentives can assist in promoting weight loss, they are not a standalone solution. Successful and sustainable weight loss requires a holistic approach involving lifestyle changes, nutritional guidance, physical activity, and often psychological support.

Exploring the Ethical Implications of Premium-Based Interventions

Interventions based on varying insurance premiums pose ethical considerations. These include questions of individual rights, fairness in pricing, and potential stigmatization or discrimination.

Balancing individual rights and societal health

While higher premiums for unhealthy habits aim to promote societal health, they may be deemed as interference with an individual’s personal choices. It’s crucial to strike a balance between advocating for healthier societies and respecting personal autonomy.

The question of fairness in premium pricing

There’s ongoing debate about the fairness of higher premiums for individuals with unhealthy lifestyles. Critics argue that it penalizes those with poorer health due to lifestyle habits without acknowledging the broader social and environmental factors contributing to these habits.

Potential for discrimination or stigmatization

Another ethical concern is that higher premiums could lead to discrimination against or stigmatization of certain groups, particularly smokers and individuals with obesity. Ensuring that these individuals are not marginalized is a key challenge in implementing such policies.

Legislative Approaches to Discouraging Smoking and Obesity

Legislative action can also play a pivotal role in unhealthy habit deterrence. Through regulatory measures, policymakers can influence insurance premium calculations and shape public attitudes toward healthy lifestyles.

Laws affecting health insurance premium calculations

Several countries have laws that allow insurers to vary premiums based on lifestyle choices. For instance, the Affordable Care Act in the United States permits insurers to implement a tobacco surcharge, effectively increasing the premiums for smokers.

The impact of public policies on lifestyle behaviors

Public policies can have a profound impact on shaping lifestyle behaviors. For example, policies mandating calorie counts on menus or requiring insurance coverage for obesity treatments can make healthy choices more accessible and more appealing.

Comparing international approaches

Different countries have different approaches toward discouraging unhealthy lifestyles through insurance premiums. While some countries like the United States allow lifestyle-based premium variations, others, such as many European countries, do not allow premium differences based on lifestyle choices. This diversity in approaches provides an opportunity to compare their effectiveness and learn from each other.

Alternative Methods to Encourage Healthy Lifestyles

Beyond premium-based interventions, other means can be employed to encourage healthier lifestyles. Wellness programs, preventive care, and education are key strategies worth exploring.

Promoting wellness programs in workplaces

Workplace wellness programs can play a crucial role in promoting healthy lifestyles. They often include health education, fitness incentives, stress management courses, and health screenings, aiming to cultivate a culture of wellness and create healthier habits among employees.

Expanded coverage for preventive care services

Ensuring ample coverage for preventive healthcare services can motivate individuals to take a proactive approach to their health. This may include screenings for cancer and chronic diseases, vaccination coverage, or even counseling sessions for a healthy diet or smoking cessation.

Education and awareness campaigns

Education and mass awareness campaigns can be an effective way to promote healthy living. The awareness about the harmful effects of smoking or obesity and the importance of physical activity and balanced diets can steer public behavior toward healthier choices.

The Future of Health Insurance Premiums and Lifestyle Choices

As society evolves and technology advances, the interaction between health insurance premiums and lifestyle choices is likely to reflect these changes, heralding new possibilities and challenges.

Potential for technology in promoting health

Wearable fitness technology, mobile apps, telemedicine, and gamified health challenges are revolutionary advancements that can facilitate healthier lifestyles. With the potential to closely track lifestyle habits, they can be instrumental in aiding future premium calculations.

Changing societal attitudes towards smoking and obesity

Shifting societal perceptions and increased awareness of the dangers associated with smoking and obesity might lead to enhanced self-regulation of these habits, minimizing their prevalence and associated health risks.

Predicted trends and shifts in health insurance industry

Health insurance is a dynamic industry, constantly adjusting to keep pace with medical advances, societal changes, and evolving risks. As we venture into the future, we expect a more personalized approach to premium calculations, better rewarding individual efforts to maintain or improve health, and continually forging a stronger link between our lifestyle choices and insurance premiums.

In this journey towards a healthier future, one fact remains constant: our lifestyle choices matter, not only for our well being but for our financial health too. By understanding and harnessing the relationship between our health insurance premiums and lifestyle choices, we can empower ourselves to make healthier decisions and embrace a brighter, healthier future.